Analysis of the Development Prospects of Graphene in the Energy Storage Field

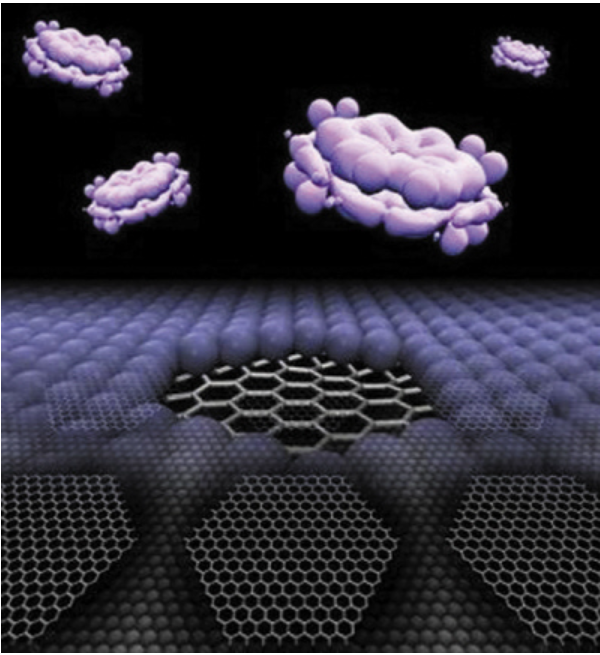

Graphene, due to its unique physicochemical properties—such as high conductivity, large specific surface area, and excellent mechanical strength—exhibits great potential in the energy storage sector. Considering the current policy environment, technological advancements, and market demand, its future industrial development can be analyzed from the following aspects.

I. Policy Support and Strategic Deployment

1. China:

- The Chinese government has incorporated graphene into the “14th Five-Year Plan” for new materials development. Several provinces (e.g., Jiangsu, Guangdong) have introduced dedicated policies, established industrial parks, and provided financial support.

- The Ministry of Science and Technology promotes graphene energy storage research through key R&D programs, while local governments offer subsidies for application demonstration projects.

2. Europe, the US, Japan, and South Korea:

- The EU’s “Graphene Flagship Program” has allocated €1 billion, focusing on energy storage applications. The US Department of Energy funds graphene battery research.

- Companies from Japan and South Korea (e.g., Samsung, Panasonic) are securing patents for graphene electrode materials, accelerating commercialization.

Policy Drivers:

- R&D subsidies, industrial pilot projects, standardization efforts, environmental regulations

II. Technological Progress and Key Application Scenarios

1. Lithium-Ion Batteries (LIBs):

- Electrode Material Modification: Graphene serves as a conductive additive, improving electrode conductivity (e.g., CATL’s patented technology). It can also be combined with silicon-based anodes to mitigate volume expansion, though large-scale production remains costly.

- Fast Charging Breakthroughs: Graphene coating technology accelerates lithium-ion diffusion, making it suitable for EV fast-charging batteries. Some companies have already entered the pilot production stage.

2. Supercapacitors:

- Leveraging graphene’s high specific surface area, supercapacitors can achieve an energy density of over 30 Wh/kg, gradually replacing traditional capacitors in rail transit and grid frequency regulation applications.

3. Emerging Battery Technologies:

- Graphene acts as a conductive framework in sodium, potassium, and aluminum-ion batteries, addressing low ion mobility issues. Currently, these technologies are transitioning from laboratory research to industrialization.

Technical Challenges:

- High-quality graphene production at scale (CVD method is expensive, while reduction-oxidation methods have defects).

- Compatibility with existing processes.

- Long-term cycling stability validation.

III. Industrialization Path and Market Prospects

1. Short-Term (3–5 years):

- Penetration into high-end niche markets: High-power batteries for drones and specialized equipment; supercapacitors in smart grids.

- Priority for composite materials: Blending graphene with traditional carbon materials (e.g., carbon black) enhances performance at a lower cost, making it easier for industrial adoption.

2. Mid-Term (5–10 years):

- Mass adoption in EV batteries: If graphene electrode costs drop below $50/kg, it could be integrated into premium electric vehicles, increasing battery range by 10–20%.

- Demonstration projects in energy storage stations: With policy incentives, graphene-enhanced batteries could be used in grid frequency regulation and backup power applications.

3. Long-Term (10+ years):

- Breakthrough innovations: Graphene-based solid-state batteries and flexible energy storage devices could create entirely new applications, such as wearable electronics and building-integrated energy storage.

Market Forecast:

According to IDTechEx, the global graphene energy storage market is expected to exceed $5 billion by 2030, with a compound annual growth rate (CAGR) of ~25%.

IV. Key Challenges and Strategies

1. Cost Reduction:

- Developing low-energy production methods (e.g., improved mechanical exfoliation) to lower graphene powder prices from $100–200/kg to $20–50/kg.

2. Supply Chain Collaboration:

- Encouraging joint R&D efforts between battery manufacturers and material companies to establish pilot production lines.

- Establishing standardized material-device performance evaluation metrics.

3. Strategic Technology Selection:

- Avoiding excessive pursuit of “pure graphene” and focusing on gradient products (e.g., few-layer graphene, graphene composites) tailored for different application needs.

V. Conclusion

The industrialization of graphene in energy storage will follow a “stepwise penetration” model:

- Short-term: Introduced as an additive in high-end markets.

- Mid-term: Expansion through composite materials.

- Long-term: Driven by disruptive innovations.

With policy incentives and cost reduction efforts, graphene is expected to achieve large-scale applications in supercapacitors and fast-charging lithium-ion batteries before 2030. However, fully replacing traditional materials will require breakthroughs in cost efficiency and manufacturing processes.

To succeed, companies should:

- Focus on differentiated application scenarios.

- Collaborate with research institutions to accelerate technology transfer.

- Address sustainability challenges (e.g., environmental impact and recycling).