Industrialization of Graphene-CNT Composites: Opportunities, Challenges, and Market Readiness

Introduction: The Power of Combining Carbon Allotropes

Both graphene and carbon nanotubes (CNTs) are revolutionary nanomaterials with exceptional mechanical, electrical, and thermal properties. When combined into hybrid composites, these materials unlock new functional advantages that surpass what each can achieve individually.

From ultra-strong lightweight materials to high-performance conductive fillers, graphene-CNT composites are driving innovation across multiple industries. But the path from lab to large-scale production presents technical and economic hurdles that must be addressed.

Part 1: Why Combine Graphene and CNTs?

1.1 Complementary Properties

| Property | Graphene | CNT | Synergistic Benefit |

|---|---|---|---|

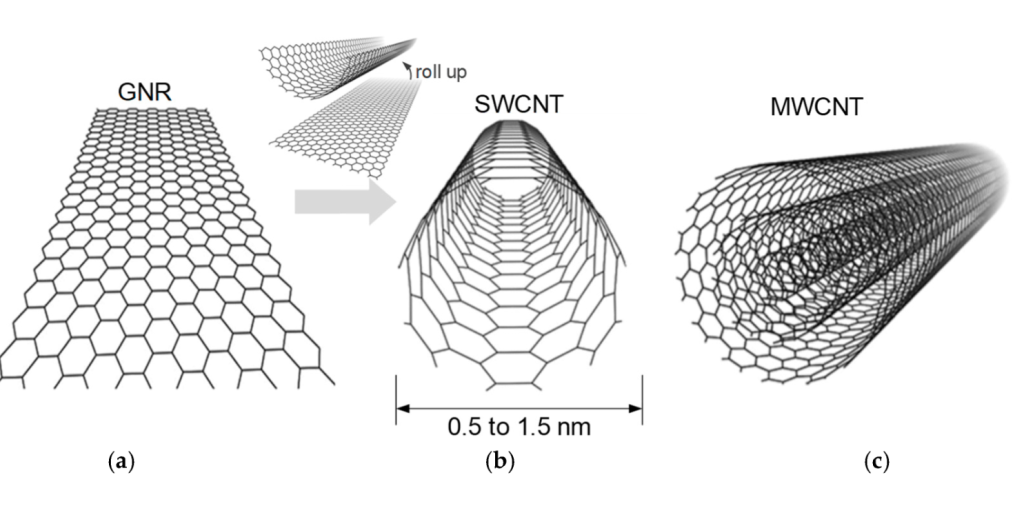

| Structure | 2D planar | 1D tubular | 3D percolation networks |

| Conductivity | Excellent | Excellent | Enhanced electron/heat paths |

| Mechanical Strength | High (130 GPa) | Very high (100 GPa) | Crack-bridging, reinforced matrix |

| Processability | Moderate | Moderate | Improved dispersion and alignment |

🧪 Result: Graphene fills in voids while CNTs act as “pillars”, forming a stronger, better-connected 3D network.

1.2 Application Gains

-

Higher mechanical strength than pure graphene or CNT composites

-

Improved thermal conductivity in polymers and resins

-

Lower percolation threshold for conductivity

-

Enhanced flexibility and fatigue resistance

Part 2: Industrial Use Cases of Graphene-CNT Composites

2.1 Structural Composites for Transportation

-

Automotive: Lightweight graphene-CNT reinforced parts reduce fuel consumption

-

Aerospace: Enhanced impact resistance and fatigue life

-

Railways: Fire-retardant interior components

🚗 Example: Companies like Ford and Airbus have tested graphene-CNT polyamide and epoxy blends for lightweight interior structures.

2.2 Conductive and EMI-Shielding Materials

-

CNT provides long-range conductivity

-

Graphene ensures high surface conductivity

-

Applications:

-

Electromagnetic shielding in electric vehicles

-

Conductive paints for electronics

-

Anti-static enclosures

-

📶 Effectiveness: Graphene-CNT composite coatings can achieve EMI shielding effectiveness >60 dB at 1–10 GHz.

2.3 Thermal Interface Materials (TIM)

-

Used in CPUs, LEDs, 5G devices

-

Graphene + CNT improve heat dissipation by ~200–400% over standard fillers

2.4 Energy Storage

-

Supercapacitor electrodes with graphene-CNT networks

-

Li-ion and Na-ion battery anodes with superior charge/discharge performance

2.5 Additive Manufacturing

-

Composite powders and filaments for 3D printing

-

Functional inks for flexible electronics or sensors

Part 3: Scalable Manufacturing and Processing

3.1 Current Manufacturing Methods

| Process | Description | Scale |

|---|---|---|

| Solution blending | Mixing graphene/CNTs in solvents | Lab-scale, scalable |

| In-situ polymerization | Dispersed during monomer formation | Medium scale |

| Melt blending | Composite integrated during extrusion | Industrially scalable |

| Layer-by-layer (LbL) deposition | Thin film creation | Microelectronic scale |

⚙️ Preferred: Melt blending and solution casting show the most promise for industrial applications due to low cost and continuous processing.

3.2 Challenges in Processing

-

Dispersion: CNTs and graphene tend to agglomerate due to van der Waals forces

-

Functionalization: Needed to improve interfacial bonding

-

Alignment: Critical for directional conductivity and strength

3.3 Quality Control

-

Ensuring consistent graphene/CNT ratio

-

Maintaining purity, especially removal of metal catalysts

-

Standardization of sheet size, tube length, and surface area

Part 4: Commercial and Market Outlook

4.1 Market Segments

| Sector | Application | Forecast CAGR |

|---|---|---|

| Aerospace | Structural composites | 18% |

| Automotive | EMI shielding, weight reduction | 21% |

| Electronics | TIM, conductive films | 23% |

| Energy | Battery and capacitor electrodes | 25% |

🌍 Overall Market Estimate: The graphene-CNT composites market is projected to reach $2.1 billion by 2030, up from $290M in 2024.

4.2 Key Players and Partnerships

-

Haydale Graphene Industries: Hybrid inks and coatings

-

Directa Plus + Comerio Ercole: Automotive composites

-

Nanotech Energy (US): Graphene-CNT energy storage

-

SABIC, Arkema, BASF: Working on CNT-graphene enhanced plastics

4.3 OEM Adoption Drivers

-

Lightweighting mandates in EV and aerospace sectors

-

5G shielding and thermal needs

-

Increased sustainability through longer life cycles and recyclability

Part 5: Bottlenecks and Path Forward

5.1 Material Costs

-

Graphene oxide (GO) and MWCNTs are becoming affordable, but high-purity SWCNTs remain expensive

-

Blended solutions using industrial-grade graphene and CNT help reduce total cost

5.2 Environmental and Safety Considerations

-

Dust exposure of CNTs remains a health concern

-

Solution: Embed in matrix early, or coat surfaces for stability

5.3 Lack of Industry Standards

-

No global standards for “graphene-CNT composite” definitions

-

Performance data varies across suppliers

-

Standardized testing protocols are needed for OEM confidence

Part 6: Strategic Outlook for Stakeholders

For Material Producers:

-

Focus on formulation packages: ready-to-use dispersions, pellets, or masterbatches

-

Offer process consulting for OEM integration

For Manufacturers:

-

Conduct pilot-scale trials in real production lines

-

Partner with nanotech startups for IP access

For Investors:

-

Look at scaling tech like roll-to-roll graphene-CNT film printing

-

Follow defense/aerospace innovation grants for early adoption

Conclusion: The Carbon Composite Era Is Here

Graphene-CNT composites are not science fiction—they are already in prototypes, demonstrators, and pre-commercial products across aerospace, electronics, energy, and transportation.

With scalable manufacturing and growing market pull, the key to unlocking their value lies in interdisciplinary collaboration and industrial readiness.

💡 Companies that develop cost-effective, performance-proven composites will shape the future of materials science for decades to come.