Commercialization Challenges of Graphene Fire-Resistant Paints

Fire-resistant paints are a cornerstone of modern safety engineering, protecting buildings, vehicles, ships, and electronics from catastrophic fire events. Traditional systems—such as intumescent paints, halogenated retardants, and mineral-based coatings—have served the industry for decades but face growing scrutiny over toxicity, environmental concerns, and limited durability.

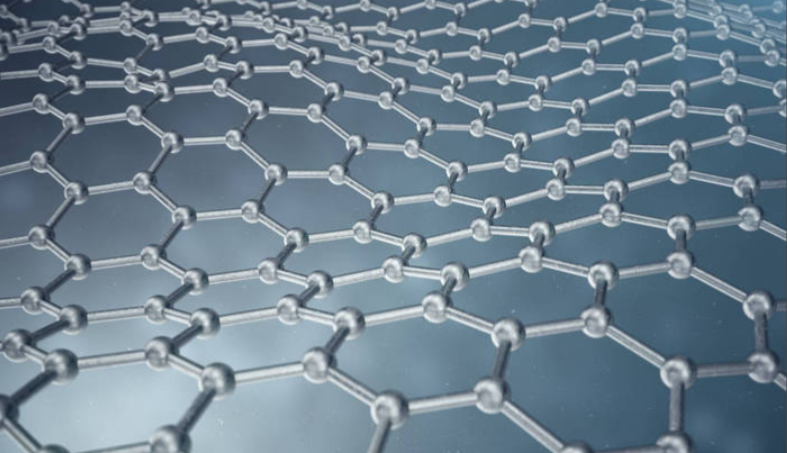

Graphene, the two-dimensional carbon nanomaterial, has emerged as a revolutionary alternative. With exceptional thermal stability, mechanical strength, and eco-friendliness, graphene-enhanced paints promise lightweight, durable, and multi-functional fire protection. Yet, despite promising laboratory results, commercial adoption remains slow.

This article explores the commercialization challenges of graphene fire-resistant paints, focusing on technical, economic, regulatory, and market-related barriers—and what must change for graphene coatings to reach full-scale adoption.

Why Graphene Fire-Resistant Paints Hold Promise

Graphene brings unique advantages that traditional flame-retardant systems cannot match:

-

Thermal Barrier → Graphene sheets slow down heat transfer, reducing flammability.

-

Tortuous Path Effect → Creates a diffusion maze, blocking oxygen and volatile gases.

-

Char Formation → Enhances the stability of intumescent foams in fire-resistant paints.

-

Lightweight Protection → Effective at low loadings (1–5%), unlike mineral fillers that require 40–60%.

-

Eco-Friendly → Non-toxic, halogen-free, and recyclable.

-

Multi-Functional → Beyond fire resistance, graphene adds corrosion resistance, EMI shielding, and mechanical reinforcement.

These properties make graphene paints attractive for construction, automotive, aerospace, electronics, and marine industries. However, turning lab-scale innovations into mass-market products is a complex challenge.

Key Commercialization Challenges

1. Production Cost and Scalability

-

High-quality graphene (single-layer or few-layer) remains expensive to produce at scale.

-

Methods like chemical vapor deposition (CVD) and liquid-phase exfoliation yield excellent material but are costly.

-

Lower-cost graphene oxide (GO) and reduced graphene oxide (rGO) are more affordable but may compromise performance.

-

Without cost reduction, graphene paints struggle to compete with established, low-cost flame retardants like aluminum hydroxide.

2. Dispersion and Compatibility Issues

-

Graphene tends to agglomerate in polymer or paint matrices.

-

Uniform dispersion is crucial for effective flame-retardant performance.

-

Surface functionalization helps but adds complexity and cost.

-

Poor dispersion reduces fire resistance and can even weaken coating durability.

3. Standardization and Testing Protocols

-

Flame-retardant coatings undergo rigorous safety testing (e.g., ASTM, UL, ISO standards).

-

No universal standardized methods exist for graphene-based paints.

-

Lack of certification protocols slows regulatory approval and industrial adoption.

4. Performance Consistency

-

Lab studies show strong fire resistance, but scaling up to industrial formulations introduces variability.

-

Different graphene sources and grades lead to inconsistent results.

-

Industries like aerospace and construction demand predictable, repeatable performance.

5. Regulatory and Environmental Considerations

-

Nanomaterials face strict scrutiny for environmental and health impacts.

-

Long-term effects of graphene nanoparticles in paints are not fully understood.

-

Regulatory uncertainty discourages large-scale industrial investment.

6. Market Resistance and Industry Inertia

-

Fire safety is a highly conservative market—companies rely on trusted, certified systems.

-

Adoption of graphene requires rethinking formulations, testing, and certifications.

-

Risk-averse industries may prefer incremental improvements to existing flame retardants over disruptive change.

7. Cost-Benefit Analysis

-

Many industries focus on upfront costs rather than lifetime savings.

-

While graphene paints may reduce maintenance, weight, and re-coating needs, the initial higher cost is a major barrier.

Industry Perspectives

Construction Sector

-

Buildings require certified intumescent coatings for steel structures.

-

Graphene-enhanced paints could reduce thickness and improve durability, but certification hurdles remain high.

Automotive and EVs

-

Fire safety in electric vehicle battery packs is a critical issue.

-

Graphene paints could improve safety, yet automakers are cautious about supply chain stability and costs.

Aerospace

-

Lightweight fire protection is crucial for aircraft interiors and fuselage.

-

Graphene’s cost and lack of standardization limit current use to research projects.

Electronics

-

Consumer electronics could benefit from thin, graphene-based flame-retardant coatings.

-

Here, miniaturization and multi-functionality (fire + EMI shielding) are attractive—but regulatory uncertainty for nanomaterials is slowing commercialization.

Opportunities for Overcoming Challenges

1. Hybrid Formulations

-

Combining graphene with traditional flame retardants (phosphorus, intumescents, minerals) can balance cost and performance.

-

Hybrid paints use less graphene, reducing costs while enhancing durability.

2. Scalable Graphene Production

-

Advances in graphene oxide (GO) production and low-cost exfoliation techniques may bridge the affordability gap.

-

Partnerships between graphene producers and coating manufacturers are critical.

3. Standardization and Certification

-

Development of graphene-specific flame-retardant standards will accelerate regulatory approval.

-

Industry consortia (e.g., Graphene Flagship in Europe) are pushing for common testing frameworks.

4. Government and Industry Collaboration

-

Public funding and regulatory support can encourage pilot projects in infrastructure and EVs.

-

Mandates for halogen-free, non-toxic coatings may create market pull for graphene.

5. Market Education and Demonstration Projects

-

Case studies showcasing lifetime cost savings and environmental benefits can shift industry perception.

-

Real-world demonstrations (bridges, ships, EVs) will build trust.

Future Outlook

Despite challenges, the graphene fire-resistant paints market shows strong growth potential:

-

Short-Term (2025–2028) → Hybrid coatings combining graphene with phosphorus or intumescent systems enter niche markets (electronics, EV batteries).

-

Mid-Term (2028–2035) → Wider adoption in construction and aerospace, as costs drop and standards evolve.

-

Long-Term (2035+) → Graphene coatings may become the default eco-friendly flame-retardant solution, replacing toxic halogenated systems.

With increasing fire safety regulations, demand for eco-friendly coatings, and graphene production scaling up, commercialization barriers are likely to fall.

Graphene fire-resistant paints promise a safer, lighter, and more sustainable alternative to traditional flame-retardant coatings. Their ability to combine thermal stability, mechanical durability, and environmental friendliness makes them highly attractive for industries from construction to aerospace.

However, commercialization faces significant hurdles: high costs, dispersion challenges, regulatory uncertainty, lack of standardized testing, and conservative market behavior. Overcoming these barriers requires scalable production, hybrid formulations, certification frameworks, and real-world demonstration projects.

As industries push toward non-toxic, lightweight, and multi-functional coatings, graphene will play a transformational role—but only if commercialization challenges are strategically addressed.

In the next decade, graphene fire-resistant paints could move from lab-scale novelty to mainstream adoption, reshaping global safety standards and unlocking a new era of sustainable protective coatings.