Carbon Nanotubes: A Turning Point is Approaching, New Domestic Capacity Urgently Needed

CITIC Securities published a research report stating that carbon nanotubes (CNTs) are benefiting from the increasing penetration of new technologies such as fast charging, solid-state batteries, and silicon anodes. This is driving both consumption growth and product upgrades. Additionally, new single-walled carbon nanotubes (SWCNTs) with superior performance are expected to be introduced into the market soon. According to estimates, the CNT industry is projected to reach a market size of 41.9 billion RMB by 2030, with single-walled carbon nanotubes contributing 41% of this figure. A significant supply gap is anticipated to emerge over the next two years.

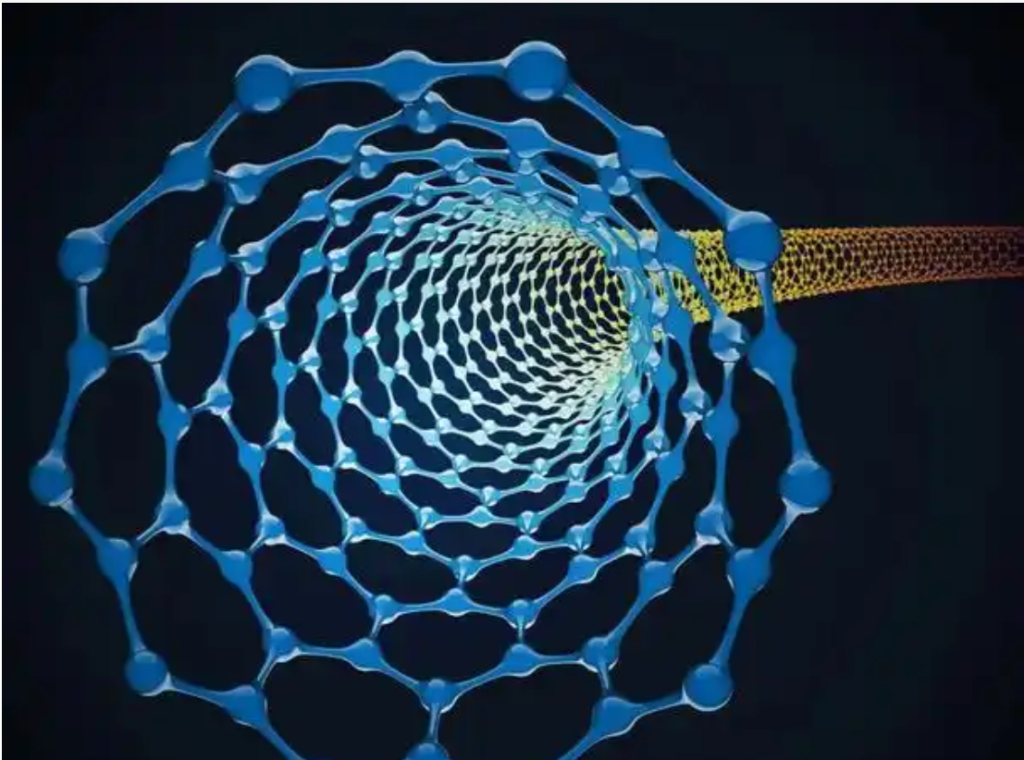

Carbon nanotubes are critical conductive agent materials that enhance the electronic conductivity of lithium-ion batteries, improve charging speed, and extend cycle life. Tianyuan Technology’s market share increased from 31% in 2017 to 47% in 2023, while Do-Fluoride Chemicals (DAOFLUORINE) grew its share to 19% in 2023. Other manufacturers saw their shares decline. This trend is attributed to the leading companies’ consistent product and profitability advantages, as well as high barriers for battery customer validation, which create customer stickiness and make it difficult for new entrants to gain traction. As a result, the industry structure is becoming increasingly consolidated.

According to CITIC Securities’ calculations, the market size for multi-walled carbon nanotube (MWCNT) slurry is expected to reach 24.8 billion RMB by 2030, with a compound annual growth rate (CAGR) of 33% from 2024 to 2030. Considering the addition of single-walled carbon nanotube powder, the total CNT industry market size is projected to be 41.9 billion RMB by 2030, with SWCNTs contributing 41%. The CAGR for SWCNTs from 2024 to 2030 is forecasted to be 43%, providing new growth momentum for the industry.

Currently, OCSiAl is the only company capable of large-scale production of SWCNTs, and the global supply of SWCNTs is predominantly provided by OCSiAl. Due to the growing demand in the lithium battery industry, it is estimated that there will be a supply gap of approximately 75 tons for SWCNT powder in 2026, which is expected to expand to 296 tons by 2027. Domestic production capacity urgently needs to be expanded and released to meet the growing demand.