Natural vs Synthetic Graphite: Properties, Selection, and Export Trends

Introduction

Graphite, one of the most versatile carbon allotropes, plays a critical role in industries ranging from refractories and batteries to metallurgy and lubrication. While both natural graphite and synthetic graphite offer unique advantages, choosing the right type for a given application involves understanding their origin, structure, cost-performance balance, and supply chain dynamics.

In this article, we compare natural and synthetic graphite from a technical and commercial perspective, explore their respective use cases, and analyze China’s export structure and trends in these two segments.

1. Origin and Production Process

Natural Graphite

-

Mined from geological deposits

-

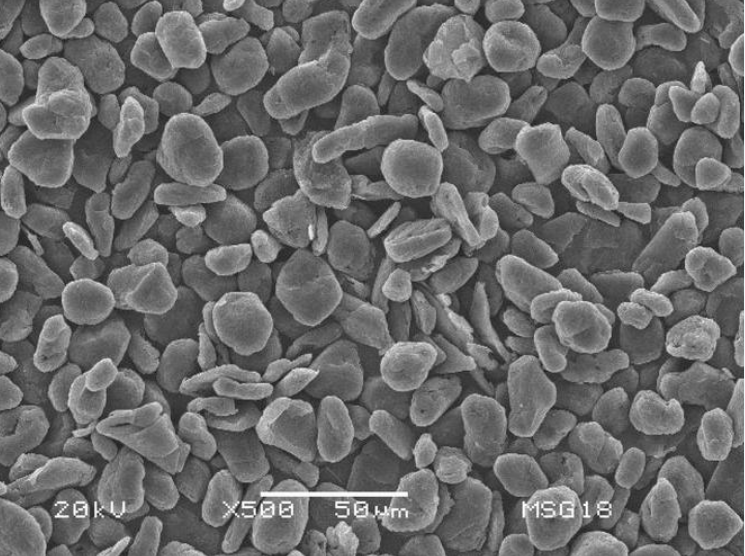

Comes in three forms: flake, amorphous, and vein

-

Requires purification (mechanical + chemical) to achieve higher carbon contents

Main Chinese sources: Heilongjiang (flake), Hunan (amorphous), Inner Mongolia (large flake, emerging)

Synthetic Graphite

-

Man-made by heat-treating petroleum coke or coal tar pitch at temperatures above 2800°C

-

Offers more consistent structure and higher purity

-

Types include: isostatic graphite, extruded graphite, molded graphite

Production hubs in China: Shandong, Henan, Chongqing

2. Physical and Chemical Properties Comparison

| Property | Natural Graphite | Synthetic Graphite |

|---|---|---|

| Carbon Content | 85–99.9% (after purification) | >99.9% |

| Density | 1.6–2.2 g/cm³ | 1.6–1.85 g/cm³ |

| Electrical Conductivity | Medium–High | Very High |

| Thermal Conductivity | High | Very High |

| Ash Content | Higher (0.5–5%) | Very Low (<0.1%) |

| Porosity | Low | Controllable (tailored) |

| Cost | Lower | Higher |

| Sustainability | Natural extraction | Fossil fuel-based, high energy |

Summary:

-

Natural graphite is cost-effective, suitable for bulk use (e.g., refractories, friction materials)

-

Synthetic graphite is ideal for precision electronics, nuclear use, high-purity anodes

3. Application Scenarios

| Industry | Preferred Type | Reason |

|---|---|---|

| Lithium-ion Batteries | Natural (bulk), Synthetic (high-end anodes) | Cycle life, density tuning |

| Refractories | Natural | Cost-effective, good thermal shock resistance |

| Metallurgy | Natural/Synthetic mix | Depends on carbon and ash requirements |

| Semiconductors | Synthetic | Ultra-high purity, shape control |

| EDM Electrodes | Synthetic | Isotropic properties, high machining accuracy |

| Nuclear Industry | Synthetic | Radiation-resistant, purity and isotropy critical |

| Brake Pads | Natural (amorphous) | Friction coefficient tuning |

China’s dual supply chain allows hybrid blending, e.g., natural + synthetic composite anode materials, increasingly seen in the EV sector.

4. Cost Structure and Processing Challenges

Natural Graphite:

-

Lower mining and processing costs

-

However, environmental cost of purification (HF acid treatment, waste handling) is rising

-

Price fluctuates based on grade (mesh + carbon) and seasonal mining capacity

Synthetic Graphite:

-

Energy-intensive production

-

Relies on high-quality needle coke, much of which is still imported

-

Prices impacted by petrochemical market and furnace availability

Trend: Blended or spherical natural graphite is gaining ground in mass-market batteries, but synthetic graphite still dominates premium applications.

5. Export Trends from China

Export Volume (2023 Data Estimate):

| Graphite Type | Volume (tons) | Major Markets |

|---|---|---|

| Natural Flake | ~500,000 | India, Japan, USA, Germany |

| Synthetic Graphite | ~160,000 | South Korea, EU, Brazil |

Notable Changes:

-

Export quota tightening for high-purity natural flake graphite since late 2023

-

Exporters must now file documentation on end-use and buyer profile

-

Synthetic graphite export is relatively unregulated, but facing logistics cost pressure

Top Export Provinces:

-

Heilongjiang: Natural flake graphite

-

Shandong, Henan: Synthetic graphite and specialty carbon materials

6. Key Chinese Companies in Each Segment

Natural Graphite Leaders:

| Company | Specialty |

|---|---|

| Qingdao Haida | Large flake, expandable graphite |

| Yixiang Graphite (Jixi) | Battery-grade spherical graphite |

| Aoyu Graphite | Natural micronized graphite |

Synthetic Graphite Leaders:

| Company | Specialty |

|---|---|

| Shanghai Shanshan Tech | Synthetic anode materials |

| Jinli Energy | Spherical synthetic graphite |

| Fangda Carbon | Electrodes, isostatic graphite |

Many of these companies now offer custom grades (particle size, surface area, tap density) for EV battery manufacturers worldwide.

7. Selection Guide: Which Type Should You Use?

Criteria 1: Purity and Ash Requirements

-

For high-purity needs (<0.1% ash): synthetic graphite is essential

-

For bulk carbon addition: natural graphite (95–98%) suffices

Criteria 2: Budget Constraints

-

If cost is a constraint and moderate conductivity is acceptable, go for natural graphite

-

Synthetic graphite should be reserved for critical components

Criteria 3: Thermal vs Electrical Performance

-

Synthetic graphite excels in electrical conductivity

-

Both types have good thermal performance, but natural flake graphite offers better oxidation resistance in some open-air applications

8. Composite Trends: Hybrid Graphite Materials

Chinese producers are now exploring blended graphite products:

-

Natural + synthetic blends for mid-range battery anodes

-

Graphene-coated natural graphite for extended cycle life

-

Graphite-silicon composite anodes for energy density gains

These composite products are exported under tight QC and are often supported by pilot-scale performance data.

9. Environmental and Policy Considerations

With China’s 2023-2025 green energy strategy:

-

HF-based purification processes are under scrutiny

-

Synthetic graphite producers are investing in closed-loop carbonization kilns

-

Natural graphite mining quotas are being refined and centralized

For international buyers, this may result in:

-

Price volatility

-

Longer lead times

-

Need for multi-source procurement

Conclusion

Choosing between natural and synthetic graphite isn’t just a material decision—it’s a strategic one. From cost to performance, purity to policy, each type has its niche.

China remains the world’s most dynamic graphite hub, with capabilities in both natural mining and synthetic processing. By understanding the properties, processing differences, and export patterns, buyers and developers can better align their needs with the right graphite supply.

As the global shift to electric mobility and decarbonization accelerates, the ability to choose—and source—the optimal graphite will be a defining edge in product performance and