The Best Single-Walled Carbon Nanotube (SWCNT) Manufacturers in 2025: Global Leaders and Technology Comparison

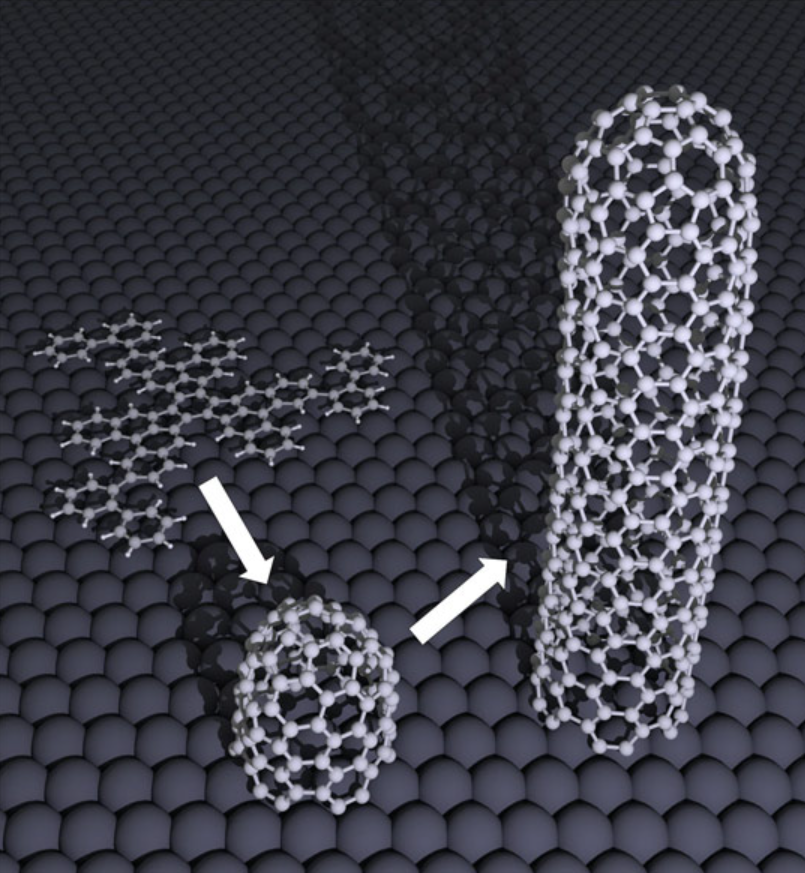

Single-walled carbon nanotubes (SWCNTs) are among the most promising materials in nanotechnology, renowned for their extraordinary electrical, thermal, and mechanical properties. However, scaling up their production to meet industrial demand remains a significant challenge, even in 2025. This article explores the global SWCNT market by identifying leading manufacturers, analyzing their production technologies, and highlighting key limitations that restrict the widespread adoption of SWCNTs.

Global Leaders in SWCNT Production

1. Russia: OCSiAl

Russia’s OCSiAl is widely regarded as the world leader in SWCNT production, controlling a substantial share of the global market. The company’s proprietary technology, Graphetron, enables the synthesis of SWCNTs at an industrial scale. With production capacities exceeding 75 tons per year, OCSiAl has set the benchmark for large-scale SWCNT manufacturing.

Advantages:

- High Purity: OCSiAl’s SWCNTs achieve purity levels exceeding 90%, making them suitable for advanced applications like conductive composites and coatings.

- Cost Efficiency: The Graphetron process leverages chemical vapor deposition (CVD) with optimized catalysts to produce SWCNTs at relatively lower costs compared to competitors.

- Strong Market Presence: OCSiAl’s broad distribution network allows them to cater to various industries, including automotive, aerospace, and electronics.

Challenges:

Despite its scale, OCSiAl still faces limitations in achieving consistent control over chirality, a key property that determines the electrical characteristics of SWCNTs.

2. China: Timesnano and Other Emerging Players

China has rapidly emerged as a key player in SWCNT production, with companies like Chengdu Organic Chemicals Co., Ltd. (Timesnano) leading the market. Chinese manufacturers benefit from government subsidies and a robust supply chain, enabling them to produce SWCNTs at competitive prices.

Advantages:

- Affordable Pricing: Chinese manufacturers often provide SWCNTs at a fraction of the cost compared to Western counterparts, making them attractive for large-scale industrial applications.

- Rapid Scale-Up: Supported by extensive R&D funding, China has achieved an annual SWCNT production capacity of approximately 30 tons, second only to Russia.

Challenges:

Chinese SWCNTs often face scrutiny regarding consistency and purity, with many manufacturers producing materials more suited to lower-end applications like bulk composites and conductive additives.

3. United States and Europe: Specialty Producers

While Russia and China dominate in terms of scale, companies in the United States and Europe focus on high-purity and research-grade SWCNTs. Notable players include NanoIntegris (US) and Meijo Nano Carbon (EU).

Advantages:

- High-Purity Outputs: These companies cater to niche markets, offering SWCNTs with purity levels exceeding 99%, ideal for high-performance electronics and research applications.

- Innovation Focus: U.S. and European companies often lead in developing advanced synthesis methods, such as floating catalyst and arc discharge techniques, to achieve greater control over chirality and defect density.

Challenges:

Limited production capacities (often less than 5 tons annually) and high production costs restrict these manufacturers to specialized markets rather than large-scale industrial applications.

Key Technological Challenges in SWCNT Production

While SWCNTs hold immense potential, scaling up their production presents several challenges:

1. Chirality Control

Chirality determines whether an SWCNT behaves as a semiconductor or a conductor. Current synthesis methods, such as chemical vapor deposition (CVD), struggle to control chirality, leading to mixtures of metallic and semiconducting nanotubes. This lack of uniformity limits the applicability of SWCNTs in electronic devices.

2. Purity and Defects

Achieving high purity (>90%) while minimizing defects remains a challenge. Impurities in SWCNTs can significantly impact their electrical and mechanical properties, rendering them unsuitable for advanced applications.

3. Production Scalability

Although companies like OCSiAl and Timesnano have made progress, scaling up production without sacrificing quality is difficult. The CVD process, while efficient, is highly sensitive to catalyst composition and reaction conditions, leading to variability in batch quality.

4. High Costs

The production of SWCNTs remains expensive due to the need for high-precision equipment, specialized catalysts, and rigorous purification processes. Prices range from $100 to $1,000 per gram, depending on purity and application.

5. Environmental Impact

The synthesis of SWCNTs often involves high energy consumption and hazardous chemicals, raising concerns about the environmental sustainability of large-scale production.

Barriers to Widespread Adoption

1. Limited Industrial Applications

Despite their exceptional properties, SWCNTs are not yet widely used in industry due to high costs and inconsistent material properties. Many manufacturers focus on low-cost alternatives, such as multi-walled carbon nanotubes (MWCNTs), for bulk applications.

2. Lack of Standardization

The absence of global standards for SWCNT quality and characterization complicates their adoption in critical industries like electronics and healthcare.

3. Competitive Pressures

The dominance of a few large players, such as OCSiAl, creates high entry barriers for smaller manufacturers, limiting innovation in the sector.

Recent Breakthroughs in Overcoming Production Challenges

Despite these challenges, significant progress has been made in recent years:

1. Catalyst Optimization

Research into new catalysts, such as bimetallic nanoparticles, has improved the efficiency and yield of the CVD process.

2. Automated Processes

Advances in automation and AI-driven process control have reduced variability in SWCNT production, improving batch-to-batch consistency.

3. Chirality-Specific Synthesis

Emerging techniques, such as template-assisted growth and molecular recognition, show promise in producing chirality-specific SWCNTs, unlocking their full potential for electronics.

Conclusion

As of 2025, Russia and China remain the dominant players in the global SWCNT market, with companies like OCSiAl and Timesnano leading in production capacity. However, the industry still faces significant challenges in scalability, cost reduction, and quality control.

Advancements in catalyst technology, process automation, and chirality-specific synthesis offer hope for overcoming these limitations, paving the way for broader adoption of SWCNTs in high-performance applications. For manufacturers and researchers alike, the focus must remain on innovation and collaboration to unlock the true potential of this extraordinary material.

SWCNTs are no longer just a laboratory curiosity—they are poised to become a cornerstone of next-generation technologies.