What Are the Economic Implications of Graphene in Advanced Materials?

— Unveiling the Economic Power of the “Wonder Material”

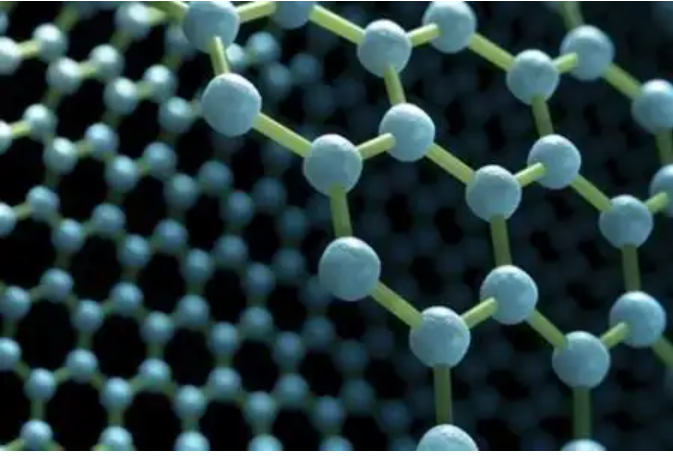

Graphene, with its atomic-scale thickness and extraordinary properties, is not just a scientific marvel—it’s an economic game changer in the world of advanced materials. As industries move toward smarter, lighter, stronger, and more sustainable materials, graphene is emerging as a high-value ingredient. But what does that mean for the global economy, supply chains, and investment landscapes?

1. Enabling Next-Generation Industries

Graphene is unlocking new markets and product categories in areas such as:

-

Flexible electronics

-

Energy storage & batteries

-

Advanced composites

-

Thermal management

-

Wearable tech

✅ Economic Impact: Drives innovation across multi-billion-dollar industries by enhancing performance without significantly increasing cost.

2. Cost-Performance Revolution in Materials

While graphene was initially expensive, mass production methods (such as chemical vapor deposition, liquid-phase exfoliation, and flash Joule heating) are reducing costs and increasing scalability.

✅ Implication: Even adding trace amounts of graphene can greatly improve material properties (e.g., conductivity, strength, barrier resistance), increasing product value at low material cost.

📈 Example: A few dollars’ worth of graphene can make paints anti-corrosive or batteries faster charging—creating significant product differentiation.

3. Boosting Industrial Efficiency

Graphene improves process efficiency and durability in manufacturing:

-

Extends product lifespan

-

Reduces energy usage in cooling/heating systems

-

Enables lighter-weight transportation for fuel efficiency

✅ Impact: Helps industries lower operational costs and reduce emissions, aligning with ESG and green economy targets.

4. Domestic Supply Chain Growth (Especially in China)

Graphene is fostering localized innovation ecosystems. Countries like China, South Korea, India, and the UK are building:

-

National graphene R&D centers

-

Startup incubators

-

Industrial parks focused on mass production and application development

✅ Economic Benefit: Strengthens local supply chains, creates high-tech jobs, and attracts investment into advanced materials and tech infrastructure.

5. Venture Capital and Startups

The graphene space is seeing strong interest from VCs and corporate R&D labs, especially in:

-

Clean energy solutions (batteries, supercapacitors)

-

Smart coatings and sensors

-

Biomedicine and drug delivery

✅ Implication: Investment is fueling rapid innovation and IP development, leading to high-potential graphene startups and acquisitions.

6. Long-Term Macroeconomic Shifts

Widespread adoption of graphene-based materials could impact global economies by:

-

Disrupting traditional materials markets (e.g., metals, plastics)

-

Accelerating the clean tech transition

-

Enabling next-gen digital infrastructure (5G, quantum tech)

✅ Projection: According to multiple market research reports, the graphene market is expected to exceed $2.5 billion by 2030, with compound growth rates over 30%.

7. Challenges to Monetization

Despite the promise, barriers remain:

-

Standardization and quality control issues

-

Uncertainty in mass adoption timelines

-

Difficulty in cost justification for some applications

⚠️ Economic Risk: Overinvestment without clear product-market fit could lead to short-term disillusionment—known as the “valley of death” for emerging materials.

Conclusion

Graphene is more than just a scientific breakthrough—it’s a strategic economic asset. Its integration into advanced materials could lead to smarter manufacturing, greener economies, and transformative products. The nations and companies that master graphene’s economics and applications will lead the future of materials science, supply chains, and industrial competitiveness.