China Develops 0.03mm Ultra-Thin Flexible glass, Promising 20+ Years of Use for Foldable Phones

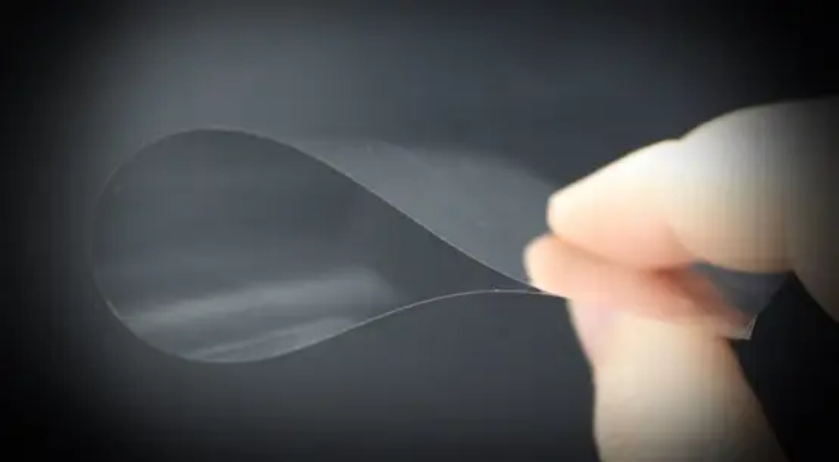

On September 15, CCTV Finance showcased a breakthrough in China’s material science—a 0.03mm ultra-thin flexible glass, currently the thinnest industrial-grade foldable glass available. This innovation places China at the forefront of advanced glass materials, breaking international monopolies.

Professor Zhang Chong, a key member of the national engineering team, revealed that if applied to foldable phone screens, this glass can withstand 100 folds per day for over 20 years. This technological breakthrough resolves critical challenges in raw material supplies, ensuring the security of both the display supply chain and broader industrial networks.

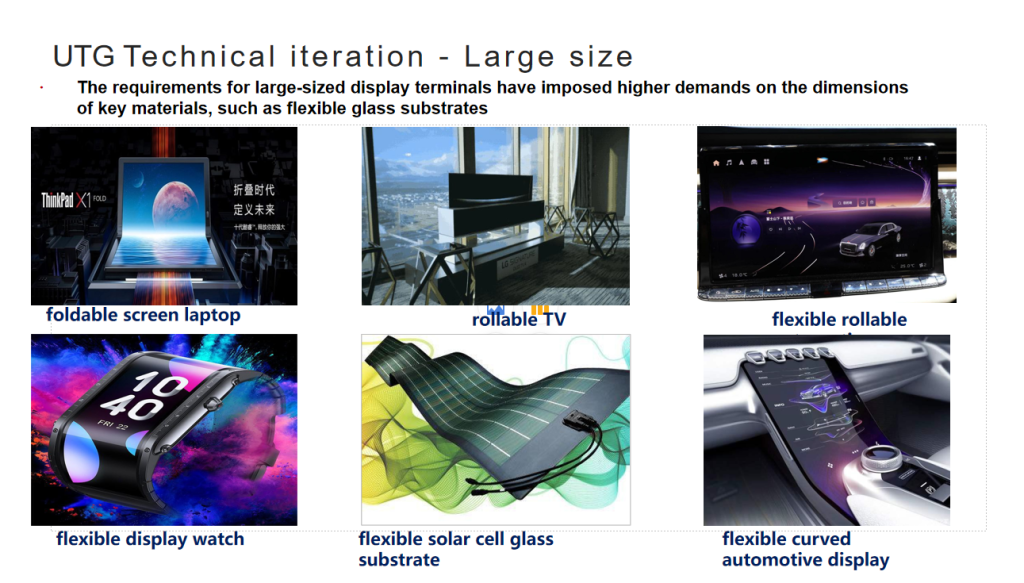

Applications of Ultra-Thin Glass (UTG): Foldable Phones and Beyond

Ultra-thin glass (UTG) offers excellent durability, strength, flexibility, and resilience, making it an essential material for foldable electronics. Its applications extend to foldable screens, automotive displays, wearable devices, and rollable screens. Among these, foldable smartphones account for 70% of UTG demand, as flexible glass plays a key role in the screen cover—a critical component for foldable displays.

There are two main materials for foldable screen covers today:

- Transparent polyimide (CPI)

- Ultra-thin flexible glass (UTG)

UTG is thinner than 1.3mm, ideal for foldable and curved displays. Initially, CPI dominated the market, with all foldable phones using CPI in 2019. However, UTG gradually replaced CPI after Samsung commercialized it in June 2020 with the Galaxy Z Flip. By 2023, 90% of foldable phones use UTG, with only 10% still relying on CPI.

Explosive Growth of the Foldable Smartphone Market

According to Counterpoint Research, global shipments of foldable smartphones grew by 48% year-over-year in Q2 2024. China has long been the world’s largest market, with 2.57 million units shipped in Q2 2023, accounting for over half of global shipments.

The foldable smartphone market is expected to grow exponentially. Shipments are forecast to increase from 13.1 million units in 2022 to 100 million units by 2027, with a compound annual growth rate (CAGR) of 50.6%. In 2024 alone, China’s foldable smartphone shipments are projected to reach 10.68 million units, up 52.4% year-over-year, according to IDC.

The recent launch of Huawei’s Mate X3 Tri-Fold Master Edition could further boost demand. With foldable phones gaining traction, the need for flexible glass is expected to grow rapidly, offering significant opportunities for the UTG industry.

Domestic vs. Overseas: Production Challenges and Supply Chain Gaps

While domestic UTG processors can meet the market demand, raw UTG glass substrates are still primarily sourced from overseas manufacturers, such as:

- Corning (USA)

- SCHOTT (Germany)

- NEG (Japan)

- AGC (Japan)

There are two main production methods for UTG:

- Primary Forming Method: Produces ultra-thin glass directly without thinning. This technique is complex and only mastered by SCHOTT and Corning. SCHOTT’s unique slot-draw process can directly manufacture 30μm glass, but Samsung holds exclusive rights to its UTG products.

- Secondary Forming Method: Involves thinning thicker glass sheets (70-300μm) to achieve 30μm thickness through advanced reduction processes. Although this method is simpler, it has challenges such as low yield, material waste, and acid-based processing risks.

Currently, Chinese manufacturers rely on the secondary forming method.

China’s 0.03mm UTG: Matching Global Standards

China’s latest breakthrough—a 0.03mm ultra-thin flexible glass—was achieved through multiple advanced processing steps, reducing the thickness by seven times. While the glass was produced using the secondary forming method, its 30μm thickness matches that of SCHOTT’s high-end products, marking a significant step for China’s high-end glass industry.

This achievement represents a milestone for China’s electronics materials sector, transitioning from zero to a leading position in UTG production. It signifies the beginning of China’s large-scale manufacturing era for micron-level glass and reduces dependence on overseas suppliers, solidifying the nation’s role in the global display technology supply chain.