Global Carbon Nanotube Production Landscape: China vs. International Markets

Introduction

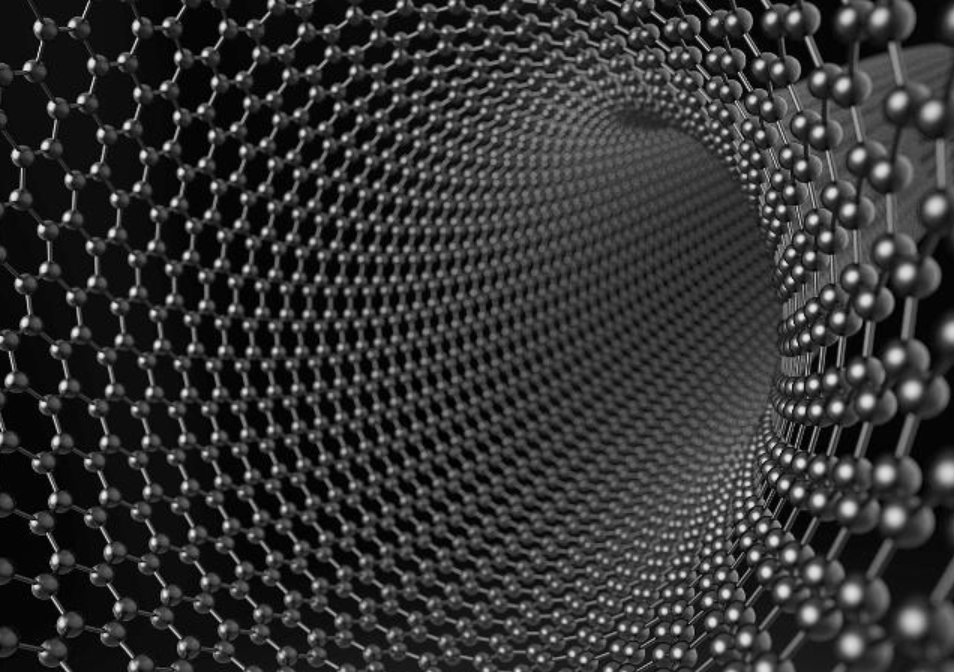

The global carbon nanotube (CNT) industry is experiencing rapid expansion, driven by demand from various sectors such as energy storage, electronics, and advanced materials. China and international markets are leading this growth, with distinct approaches, strengths, and challenges. This article analyzes the global production landscape, comparing China’s dominance with the strategies and innovations of other international players.

China’s Dominance in the CNT Market

China has emerged as the largest producer and consumer of carbon nanotubes, accounting for a significant share of the global market. Several factors contribute to its leadership position:

1. Large-Scale Production Capacity

- Statistics: China contributes to over 50% of the world’s CNT production.

- Key Producers: Leading Chinese companies, such as Timesnano, Shenzhen Nanotech Port, and Chengdu Organic Chemicals Co., dominate the domestic and international markets.

2. Cost Advantages

- Low Manufacturing Costs: Economies of scale, lower labor costs, and abundant raw materials reduce production expenses.

- Affordable Pricing: Chinese CNTs are priced competitively, attracting buyers from both emerging and developed markets.

3. Government Support

- Policies: China’s “Made in China 2025” initiative prioritizes advanced materials, including CNTs.

- Funding: Substantial R&D investments and subsidies for CNT-related projects.

4. Integration with End-Use Industries

- Focus Areas: Strong ties with battery manufacturers, electronics companies, and construction firms.

- Applications: Extensive use of CNTs in lithium-ion batteries, especially for electric vehicles (EVs) and consumer electronics.

Challenges for China

- Quality Concerns: Despite advancements, some Chinese products face criticism for inconsistent quality compared to those from Europe or the U.S.

- Environmental Impact: Rapid industrialization raises sustainability concerns.

International Market Landscape

Outside China, countries like the United States, Japan, South Korea, and Germany are significant players in the CNT industry. These markets prioritize high-quality production, advanced technologies, and niche applications.

1. United States

- Key Companies: Nanocomp Technologies, C-Nano, and Applied Nanostructures.

- Strengths:

- Focus on high-purity and single-wall CNTs (SWCNTs) for specialized applications.

- Partnerships with defense, aerospace, and energy sectors.

- Innovation: Cutting-edge research in CNT-based composites and energy storage solutions.

2. Japan

- Key Producers: Toray Industries, Showa Denko, and Zeon Corporation.

- Strengths:

- Expertise in multi-wall CNTs (MWCNTs) for automotive and electronic applications.

- Emphasis on precision manufacturing and quality assurance.

- Applications: Widely used in hybrid vehicle batteries and conductive coatings.

3. South Korea

- Key Players: LG Chem, Samsung Advanced Institute of Technology.

- Strengths:

- Leadership in CNT applications for flexible displays and advanced batteries.

- Strong government support for nanotechnology innovations.

4. Germany

- Key Companies: Bayer MaterialScience (now Covestro) and Arkema (in partnership with French firms).

- Strengths:

- High-quality CNTs for industrial and research purposes.

- Sustainability focus, integrating CNTs into green technologies.

Challenges for International Players

- Cost Competitiveness: Higher production costs compared to China.

- Scale Limitations: Smaller production volumes relative to Chinese manufacturers.

Comparison: China vs. International Markets

| Aspect | China | International Markets |

|---|---|---|

| Production Scale | Largest global producer | Smaller-scale, niche production |

| Cost | Low-cost manufacturing | Higher costs due to quality focus |

| Quality | Variable quality | High consistency and precision |

| Innovation | Rapid adoption in batteries and EVs | Cutting-edge R&D in aerospace, defense |

| Environmental Impact | Sustainability challenges | Emphasis on green manufacturing |

| Market Strategy | Price-driven, mass-market focus | Application-specific, high-value markets |

Opportunities for Collaboration and Growth

1. Bridging Quality and Scale

- Partnerships: Collaborations between Chinese and international firms can combine large-scale production with advanced quality standards.

- Technology Transfer: Sharing R&D expertise to enhance manufacturing processes.

2. Focus on Emerging Applications

- Sectors: Healthcare, 5G technologies, and renewable energy systems.

- Potential: Joint ventures to explore CNT applications in these high-growth areas.

3. Sustainability Initiatives

- Green Manufacturing: Adoption of eco-friendly production methods, particularly in China.

- Recycling: Development of CNT recycling technologies to reduce environmental impact.

Conclusion

China’s dominance in carbon nanotube production is a testament to its cost advantages and large-scale capabilities. However, international players remain competitive through innovation and high-quality production. As global demand for CNTs continues to rise, fostering collaboration and addressing sustainability challenges will be critical to driving the next phase of growth in this dynamic industry.